This IABC Trend InSight report development was led by Joe Bobbey, with support from Trend Watch Committee members Tammy Korgie, Stephen Forshaw and Dan Walraven.

Trend at a Glance

Interest in social responsibility among businesses, organizations and all types of stakeholders is increasing exponentially. New requirements and standards are rolling out to make environmental, social and governance (ESG) investment criteria more transparent and accurately reported. A recent search of the Indeed job site yielded nearly 6,000 ESG-related communication positions — more than 2,000 on LinkedIn — not to mention the countless number of business communication generalists who are supporting their ESG-focused employers or clients. Having a solid understanding of ESG and related trends is the first step to being a more effective ESG communicator.

Issues That Define ESG for Investors

ESG criteria are standards used by investors and investment firms to evaluate an organization’s value, beyond financials, when making socially responsible investment (SRI) decisions.

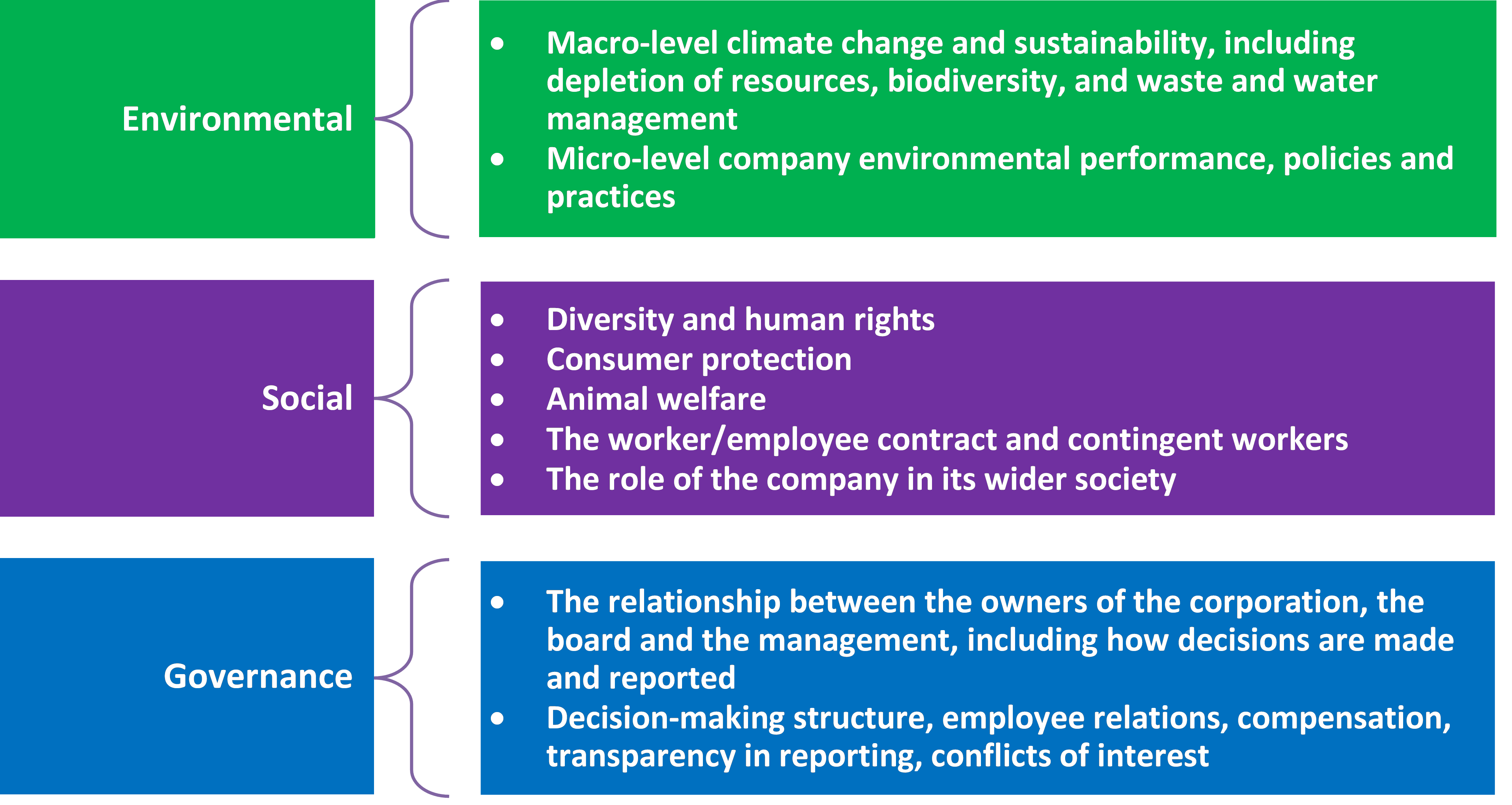

An early example of SRI was the reaction to the apartheid regime in South Africa during the 1970s, which led many investors to withdraw investments in the name of ethical concerns about the unjust practices. Since then, with a focus on corporate social responsibility (CSR) and principles of responsible investment (PRI) promoted by the United Nations and other influential institutions, ESG has come to represent the criteria used to manage and measure a growing range of global business and societal issues beyond those measured in balance sheets and income statements. It represents an increasingly standardized framework that can be used by companies to communicate on common ground with investors about their risk across three areas:

According to The Forum for Sustainable and Responsible Investment’s Trend Report (2020), the top three issues for money managers and institutional investor clients are climate change/carbon emissions, sustainable natural resources/agriculture and board issues.

Writing for CNBC, Eric Rosenbaum adds that, “While much of the public and many investors associate ESG foremost with climate and the environment, research nonprofit Just Capital’s annual public polling shows treatment of workers to be the No. 1 issue for Americans,” including the increasing shift from full-time employees to contingency workers.

One way to adopt ESG criteria is for companies to apply for B Corp Certification from the global nonprofit B Lab. These companies must pass an assessment that assures they “meet the highest standards of verified social and environmental performance transparency and accountability.” This status is not a substitute for ESG compliance but is another sign of commitment to ESG-related issues. There are currently close to 5,000 certified B Corporations in 79 countries.

A related concept is “Innovation to Zero,” introduced by Bill Gates in 2010: investing in innovative solutions that lead to zero carbon emissions. There are also other applications; for example, not just vehicles with zero emissions, but also zero accidents and zero defects. Increasingly, global investors are partnering to put capital to work into decarbonization solutions. Global institutional investor BlackRock has established a joint venture fund with Singapore investor Temasek, called Decarbonization Partners, to invest in climate solutions:

"The world cannot meet its net-zero ambitions without transformational innovation. For decarbonization solutions and technologies to transform our economy, they need to be scaled. To do that, they need patient, well-managed capital to support their vital goals. This partnership will help define climate solutions as a standalone asset class that is both essential to our collective mission and a historic investment opportunity created by the net zero transition." — Larry Fink, Chairman and CEO of BlackRock

Business Context

Standards

The ESG movement has been progressing from prior corporate recognition and public activism to more formal adoption of ESG practices and policies, plus a greater push for consistent reporting mandates. “Verification and assurance will play an ever-increasing role in confirming the accuracy of these disclosures.” (Kosmas Papadopoulos and Rodolfo Araujo, Top 10 ESG Trends for the New Decade, Harvard Law School Forum on Corporate Governance.)

While addressing NASDAQ’s focus on measuring and reporting its ESG matters, CEO Adena Friedman emphasized, “We are a disclosure economy” (CNBC, 12 January 2022).

Sample Sources of Proposed ESG Guidance or Standards

|

|

|

Stakeholders

Virtually every major group of business stakeholders is impacted by an organization’s compliance (or lack of compliance) with ESG principles.

Investment Community

ESG and CSR initially began with investors, lenders and rating agencies expecting greater transparency of non-financial metrics to understand social and environmental risks better. They have placed more pressure on organizations to make ESG commitment a priority. For public and private companies, ESG concerns can impact their access to capital.

In particular, there is a growing realization that mega-trend issues such as climate change will not be solved by governments alone. Investors are either influencing or directing pressure on companies to do what, in the past, may have been the expected responsibility of governments. They look to companies to transform business models, even being prepared to invest in, research and adopt new technologies to lower their carbon footprint, for example.

Nonprofit Organizations

Many nonprofits are dedicated to addressing the interests and needs of people and societies in the work they do. Still, ignoring ESG issues or how their actions support ESG can increase the risk of losing essential contributions and member support.

Likewise, nonprofits are champions of disclosure and reform on ESG issues by companies, so they have also become an even more significant stakeholder for companies seeking to engage a wider group of capital providers.

Consumers

Customers of an organization’s products and services are expecting more transparency and accountability when making their purchase decisions, as part of a drive to use purchasing power to influence change on environmental and social issues[1]. Organizations are especially susceptible to criticism when they use misleading marketing messages or labeling. In many countries, increasing regulatory oversight on labeling is leading to penalties and other sanctions.

Existing Employees and Potential New Hires

Companies that show a strong commitment to ESG concerns are seeing a positive impact on employee retention — including loyalty and productivity — and attracting new talent.

Organizations that don’t demonstrate ESG commitment risk losing valuable talent and even risk disgruntled workers becoming activists, whistleblowers or vocal about their grievances through social media, causing significant brand damage to the business.

Underserved Populations

When environmental and social concerns are ignored, minority populations are often impacted more than other stakeholders. ESG goals provide an opportunity to make tremendous contributions to their health and welfare, provided the efforts are genuine and sustainable.

General Public

Successful ESG actions will ultimately have major positive impact on local and global populations as the movement gains global support and there is increasing recognition that climate change mitigation requires actions by entities beyond governments, including individual companies. Millennials are already strong drivers of this movement, and more employees and other stakeholders are sharing CSR concerns on social media.

Potential Courses of Actions

As we look forward through the 2020s, the IABC Trend Watch Committee sees the greatest opportunity for companies and their communications leadership to direct efforts on optimizing an ESG strategy among their workforce and the investment community.

This is not to say other audiences are less engaged, but employee and the investment community efforts set the tone and provide a foundation for broader efforts. Communication professionals not only have the opportunity to tell their company’s story, but also to provide input or help develop their organization’s ESG strategy.

Focus on Employees

The ESG impacts on existing employees and new hires have gained attention because the COVID-19 pandemic has placed the spotlight on, and elevated the importance of, these stakeholder issues. According to the S&P Global Sustainability Yearbook 2022, employee expectations were upended by the pandemic. Employees are demanding a greater focus on health and wellness, for example, as demonstrated by worker strikes in 2020 at Amazon, Instacart and Whole Foods.

In 2021, the so-called “Great Resignation” began to sweep the globe and workers made significant career changes. Their motivations included better work-life balance, employers whose values matched their own and, in some cases, more money or improved compensation structures. Employers still suffer the consequences of this shift, faced with staff shortages and lack of candidates for open positions. In some cases, companies that furloughed or laid off staff in the pandemic have struggled to re-engage those staff as the economy turns around.

Business communicators play a key role in conveying and proving the reasons to stay at an organization. Compelling and authentic ESG communications can help employees understand that the organization they work for is committed to making a positive societal and environmental impact. If employees can see that their work and their organization’s work have purpose, they may be less likely to seek that higher purpose elsewhere. Similarly, new hires can feel proud and excited about the contributions they’ll be able to make to society and the environment through their role at their organization.

An organization’s employees are, by default, its ambassadors. They must be able to trust their employer is truly acting on its ESG commitments. theHRDIRECTOR reports that a recent study in the U.K. revealed that 43% of senior employees think their company has been guilty of greenwashing (i.e., company messages that mislead or overstate their environmental intentions). In addition, the research shows that 56% of people between 18- and 24-years-old — a group that is highly outspoken and active on social media — believe their company has been greenwashing. Business communicators must take every precaution to ensure that ESG communications are authentic.

It can’t be overstated how employees, and what they say about their company, can influence how the investment community and others perceive the company.

Focus on the Investment Community

Investor and shareholder activism related to ESG issues is gaining more attention with the potential to further erode organization or brand reputation. Shareholders are demanding a comprehensive ESG strategy, not just a single focus area such as the environment. For example, Tesla is building its success in electric vehicles and renewable energy but, as CNBC reported, questions affecting Tesla's ESG ratings touch many fronts, including waste management, labor management and product safety. Even an influential individual investor can make a difference in a company’s valuation by raising concerns over any number of ESG issues. Major investor Carl Icahn recently targeted food companies over animal welfare concerns.

A rise of mandates from the investment community, including those from banks, fund managers and rating agencies (some of whom have their own investor pressure), are forcing companies to take note and comply. Jerry Silva of IDC Insights wrote in Forbes, “The financial services industry has a stake in ESG as well, from the impact of climate change on the insurance industry to the impact of fossil fuels and alternative energy sources on the capital markets and banking industries.” One positive initiative highlighted was the Net-Zero Banking Alliance, representing about 40% of global banking assets.

Financial services and institutions have been moving to take more formal positions on their lending preferences. One sample of the move to prioritize sustainability in banking is the London-based, multi-national Standard Chartered PLC. It has an active process to engage customers and their wider group of stakeholders on issues around environmental and social sustainability to meet the expectations of a growing group of market activists. A page on its website, “How we manage environmental and social risk,” includes a position statement with its standards based on universal values: “Whichever sector our clients work in, there is a minimum set of standards that we require them to meet in order to continue working with them.”

Standard Chartered goes further to outline a series of specific position statements on key issues, including climate, that apply to customers:

“We expect all clients (beginning with those in high-carbon sectors) to have a public strategy to transition their business in line with the goals of the Paris Agreement, and we expect all clients (beginning with those in high-carbon sectors) to report their current greenhouse gas emissions, preferably in line with the Taskforce on Climate-related Financial Disclosures (TCFD).”

Investment decisions by businesses and other organizations can have a significant ripple effect on their stakeholders. Students protesting university investment in fossil fuels represent a growing movement. Reuters News Agency reported in February 2022 that students at five top-rated universities working with The Climate Defense Project have filed complaints with their states' attorneys general to investigate whether their schools' fossil-fuel investment holdings violate state laws governing investments by charities, according to a press release from the group.

While the debate about divestment of carbon-producing assets from investment portfolios is a choice being undertaken by some key investors[2], there is a growing realization and acceptance that divestment does nothing to solve the problem of carbon emissions; it merely transfers ownership of the problem to someone else. Other long-term investors see the alternative:

“Taking a principles-based approach to decarbonization may be satisfying in the near-term, but true investment in the sustainable transition — allocating capital to catalyze development of new technologies and industries while providing scale capital to remake the economy for a resilient future is far more satisfying, and rewarding, in the long term.” —Focusing Capital on the Long Term Paper: Divestment Isn’t the Answer for Decarbonization[3]

For business communicators, this momentum toward greater emphasis on ESG creates an urgency to build strong partnerships with their finance and investor relations departments to ensure communication strategies help reduce risk — and to ensure advice and counsel given to organizational leadership is principled, not merely populist.

What ESG Means for Business Leaders

Finding Purpose

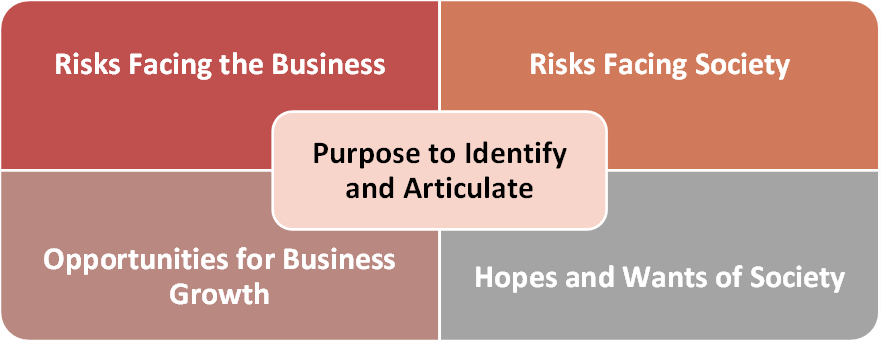

Kamyar Naficy, founder and principal of KNECTCOMMS, explains that purpose, stakeholder capitalism and ESG are interrelated concepts. “Purpose in business implies you have a purpose beyond profit maximization,” he says, and he offers a tangible way to approach purpose. Think about the risks that your business faces, the risks that society faces, the growth opportunities for your business, and the hopes and wants of society. At the intersection of these dimensions is where you should be identifying and articulating your purpose. Framed in this way, purpose combines risk management, marketing and communication.

As Naficy explains, “ESG begins with purpose. Consider your company’s core reason for being — how it meets a business need, solves customer problems and provides broader societal value.”

Words and Deeds Matter

When companies report on ESG criteria, their leadership can often find themselves fielding questions from shareholders, employees and others about their stance on particular issues. For example, what is your policy on diversity, equality and inclusion or on a particular political policy.

It’s important that leaders understand their organizations are expected to demonstrate their compliance with ESG standards with visible works and results that go beyond data. Frank Shaw, vice president of communications at Microsoft, emphasized that point in a recent episode of IABC’s PodCatalyst: “If we’re going to say something, then we need to be willing to do something, or be doing something,” or we lose trust.

Examples of ESG and CSR Reporting

|

- On its Corporate Social Responsibility website, Microsoft includes a variety of ways it reports its ESG efforts — from a presentation that combines compelling storytelling with statistics to detailed sustainability reports and data factsheets.

- Webcor, a major commercial construction contractor based in California and a subsidiary of the Japanese construction company Obayashi Corporation, launched its ESG program: People, Plant, and Performance. Its website features 35 categories with measurable objectives and key performance indicators.

- University of Colorado 2021 Sustainability Report is an example of an institutional approach to sustainability for their particular stakeholders (contributors, faculty and prospective students).

|

The consequences of not ensuring that an organization’s actions support its values can have an unexpected negative effect on its reputation. Take a company that promotes its product as being made to emit less carbon emissions when there is no corresponding effort to reduce emissions in the process of manufacturing that product; or making an essential product more affordable to the public while using cheaper offshore child labor. These could quickly become targets of criticism and potential activism, and highlight the importance of detailed effort, authenticity and consistency over time.

Staying the Course

For business leaders, ESG commitments can be daunting. Danone S.A., a multinational food-products corporation based in Paris, took a highly visible approach to ESG initiatives, performance and reporting.

In 2017, the company launched its One Planet. One Health. campaign vision for sustainable growth, followed by involvement in global programs such as the 2019 UN Climate Action Summit. However, the move toward long-term sustainability goals became blurred by shareholder activism over short-term financial results, as examined in Forbes.

In a world of global commerce, cultural standards of behavior can vary greatly from one region to another. For example, the need for child labor laws and policies may be widely agreed upon, but a company policy to offer an eight-week paid leave after childbirth that might be standard in one country may be considered draconian in its brevity in other countries. These issues may not be easily solved, and some accommodation will always have to be made for reasonable cultural differences.

It’s important to note that ESG is a journey, not a destination. The standards of acceptance are continuing to evolve and there will always be criticism until standards are broadly accepted and applied.

What ESG Means for Communication Leaders

“Currently, communication leaders largely lack a solid understanding of ESG,” says Mike Hower, head of client engagement at thinkPARALLAX. “This results in either discounting the value of communicating ESG for an organization — or conversely, overselling the organization’s ESG performance with greenwashing.”

Ensuring that business practices are accurately and consistently represented in ESG-related positions and messages will help ensure the company demonstrates transparency and trust. There is also a growing trend in communications professionals taking on the important role of sustainability[4], which shows an important and relevant career path for communications professionals, recognizing the importance of communicating sustainability outcomes for reputation.

Be Part of the Conversation … and Listen!

Communicators have a role in helping guide the progress toward goals and ensuring reportable, authentic compliance. First, understand your own organization’s efforts to date to set ESG goals and how it plans to report on them. Then learn from existing or proposed standards for setting and reporting on such goals.

Another important function of communication leadership is to develop a strategy to learn concerns and priorities from your stakeholders. The feedback can provide valuable information that leads to more effective ways to focus ESG efforts and refine reporting. Specific tactics can include community engagement meetings, stakeholder surveys and investor perception studies.

Remember, the greatest critics can come from within the organization. Listening and gathering valuable input reduces the impact of potential criticism and damage to reputation, particularly resulting from:

- Growing influence of public opinion and employee activism (e.g., having greater ability or opportunity to raise questions and challenge leadership)

- Speed and reach of social media, along with the expansion of news outlets with biased viewpoints

- Proliferation of misinformation/disinformation and the blurring of news and opinion reporting, combined with perceptions that governments cannot deliver ESG-related solutions

Telling Your ESG/Purpose Story

“ESG communication is important because your strategy is only as good as your story. Humans are story-driven creatures, and narratives are how we come to understand and act,” says Hower. “Internally, ESG communication is critical for engaging employees and others who will actually implement your strategy.” He adds that the role of communication leaders is to ensure that the company is telling an authentic, engaging story about its ongoing ESG journey. This means talking transparently about both the successes and setbacks.

Communications leaders also have an opportunity to use their understanding of ESG and input from stakeholders to help management shape its ESG position — adding value to the messaging rather than just passing along standard corporate messaging from the board or compliance office.

Purpose and Strategy

Gallagher, an internal communications agency, released its State of the Sector 2021/22 report, endorsed by IABC, which included important insights on the role for communicators in driving understanding of purpose and strategy. Based on a survey of more than 1,300 organizations across the globe, 53% named engaging teams around purpose, strategy and values as one of their top three priorities for 2022. It was the overall highest among all priorities listed.

When asked to rate their people’s understanding of their organization’s purpose and vision, 53% rated it as good or excellent. However, understanding of business strategy was rated only 47% and even less for understanding how they contribute to the organization’s purpose and strategy (41%). Lessons learned from the survey about the communicator’s role included reclaiming the narrative, prioritizing employee feedback and reaching out to gain more employee understanding. In the view of Gallagher Creative Director Howard Fry, “the smart employers will make sure they are making meaningful and authentic connections with their people.”

We see this as a rich opportunity for communications practitioners to own and lead improvement in scores using their domain expertise in communicating and managing change. Alongside ESG factors, rallying people around an organizational purpose — which itself needs to align with good ESG management — will be the next rallying point for communications professionals.

Additional Resources

[1] According to The Global Sustainability Study 2021*, conducted by global strategy and pricing consultancy Simon-Kucher & Partners, sustainability is rated as an important purchase criterion for 60% of consumers. Attitudes toward sustainability also vary by industry when measuring its importance as a purchase criterion, from 74% in energy/utilities to 44% in financial services. Construction/home (66%), consumer goods (63%), travel and tourism (62%) and automotive (61%) range in between.